my last view on nifty stood wrong and again i must admit as i always do, Market always reacts faster than anything…

We saw a huge correction in “DOW JONES” on last Wednesday ahead of the news S&P downgraded U.S. debt from AAA to AA+ and is keeping it on a negative credit watch. This is a bit surprising if only because some European countries who are in worse shape than the U.S. (and without the ability to print their own money) now have a better credit rating. What this will mean for Monday is anyone's guess. People are guessing everything from a market crash to a rally (thinking it's already been priced in). One thing is for certain, this week will likely to be a volatile week.

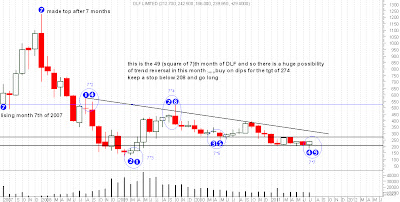

Technical studies…

The first week of Aug had been quite disappointing for the global market so the “Indian stock market”. We witnessed huge sell off pressure from all the global giants like DOW, FTSE, SHANGHAI, S&P 500 etc. Quite interesting thing to notice is, in most of the indices there is a “head & shoulder” pattern break down (except a few one) though they are not so far from their target we believe. Which indicates a short term bearish trend is going to resume.

Nifty…

This week is going to be very crucial for NIFTY as it closed last week on a very weaker note we believe, but most of the nifty-50 scripts specially Banking, FMCG, Pharma, Telecom, Auto shares (except tata motors) did not make new low despite of the fact that NIFTY made a 52 week low (on intra day basis it breached its low of 5177 made in the month of Feb’ 2011) but at the end of the day some how it managed to close above that level. But still it is the lowest ever weekly closing in this year so implication is “NIFTY bears are quite aggressive over bulls” Then which are the sectors took nifty down? Those are mainly Metals, IT and partly Oil & Gas mainly Reliance, we were always been bearish in Metal & IT pack and ultimately it came true. And we believe there is much more down side still left in these counters, specially in IT scripts they have just got into a corrective mode we believe, so stay away.

As we can see there is a triangle pattern break down in NIFTY at 5280 level. And the target comes around 4300-4500 level which is disastrous from every perspective. But the pattern breakdown confirmation only comes if we get a weekly closing below 5170 level (monthly closing is most preferred), in that case the immediate down side target is 4800-4900 level where its 38% Fibonacci retracement level stands coupled with 200 weekly EMA.

And coincidently the target of head & shoulder pattern break down also finds the immediate destination of 4900 level and this has triggered the lower top lower bottom formation for nifty after March 2009.

Though NIFTY looks to be extremely over sold in short term and a technical bounce back might take it to the 5300-5400 level which will act as the major resistance for the NIFTY in coming days.

So investors are advised to stop finding buying opportunities in such market condition, strategy should be wait and watch. And traders… try short the market on every possible technical bounce back keeping in mind 5300 to 5400 level shall act as the major resistance for the time being.